carbon tax singapore

A month later in his Budget 2022 speech the finance minister revealed proposals aimed at developing a sustainable economy including the launch of the. Changes are also afoot for Singapores carbon tax.

Carbon Tax Consultancy Singapore Carbon Footprint Legal Requirements

The carbon tax rate is set at SGP5 per ton of carbon dioxide equivalent emitted which is to apply until 2023.

. As a small country with an open export-oriented economy Bukit Panjang MP Liang Eng Hwa said with the implementation of carbon tax Singapore. A Pigovian tax also spelled Pigouvian tax is a tax on any market activity that generates negative externalities external costs incurred by the producer that are not included in the market price. The revised rate for 2024 will be announced during next months Budget which will also.

A possibility for Singapore is to therefore first set the carbon tax level at least around US8 to 9 S11 to 12 per tonne of CO2 to inject some urgency for emitters to accelerate their. We are customizing your profile. SINGAPORE A group of Members of Parliament will next week propose in Parliament a tiered carbon tax model and the setting up of an academy for sustainability-related research and development.

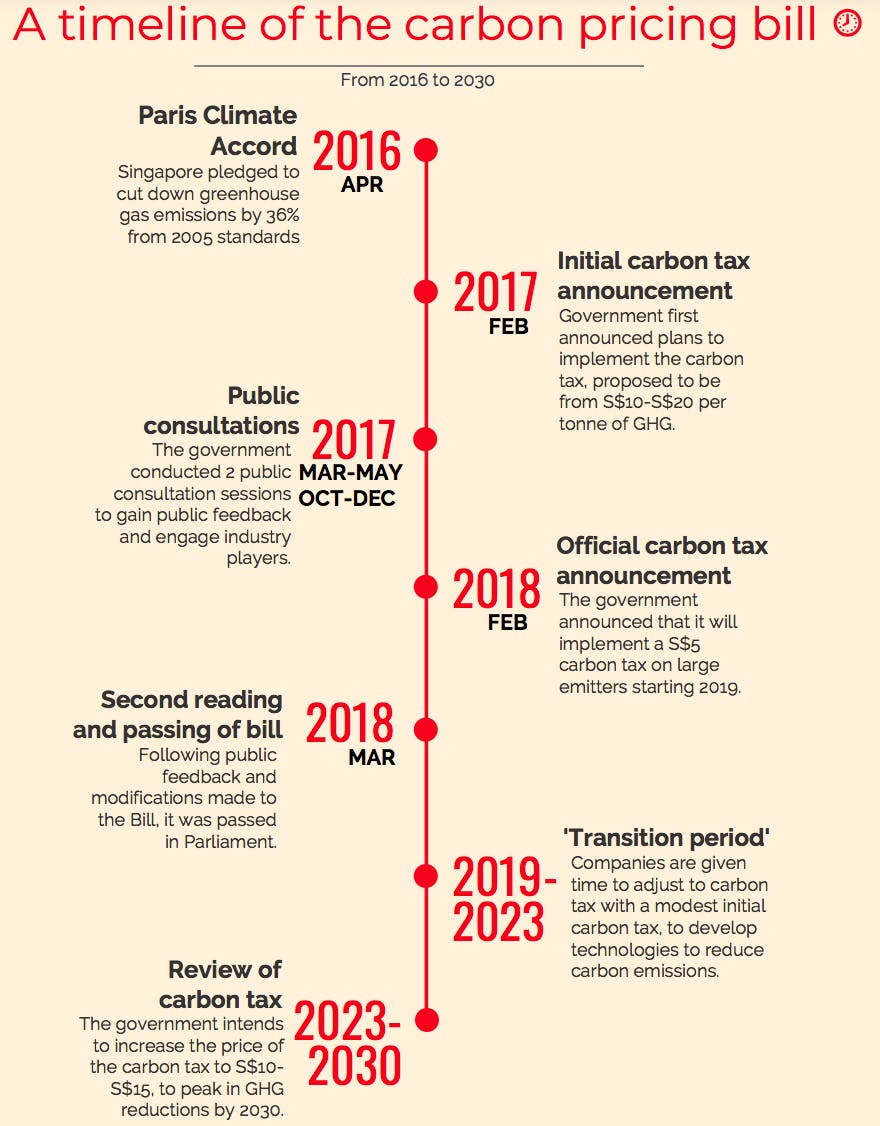

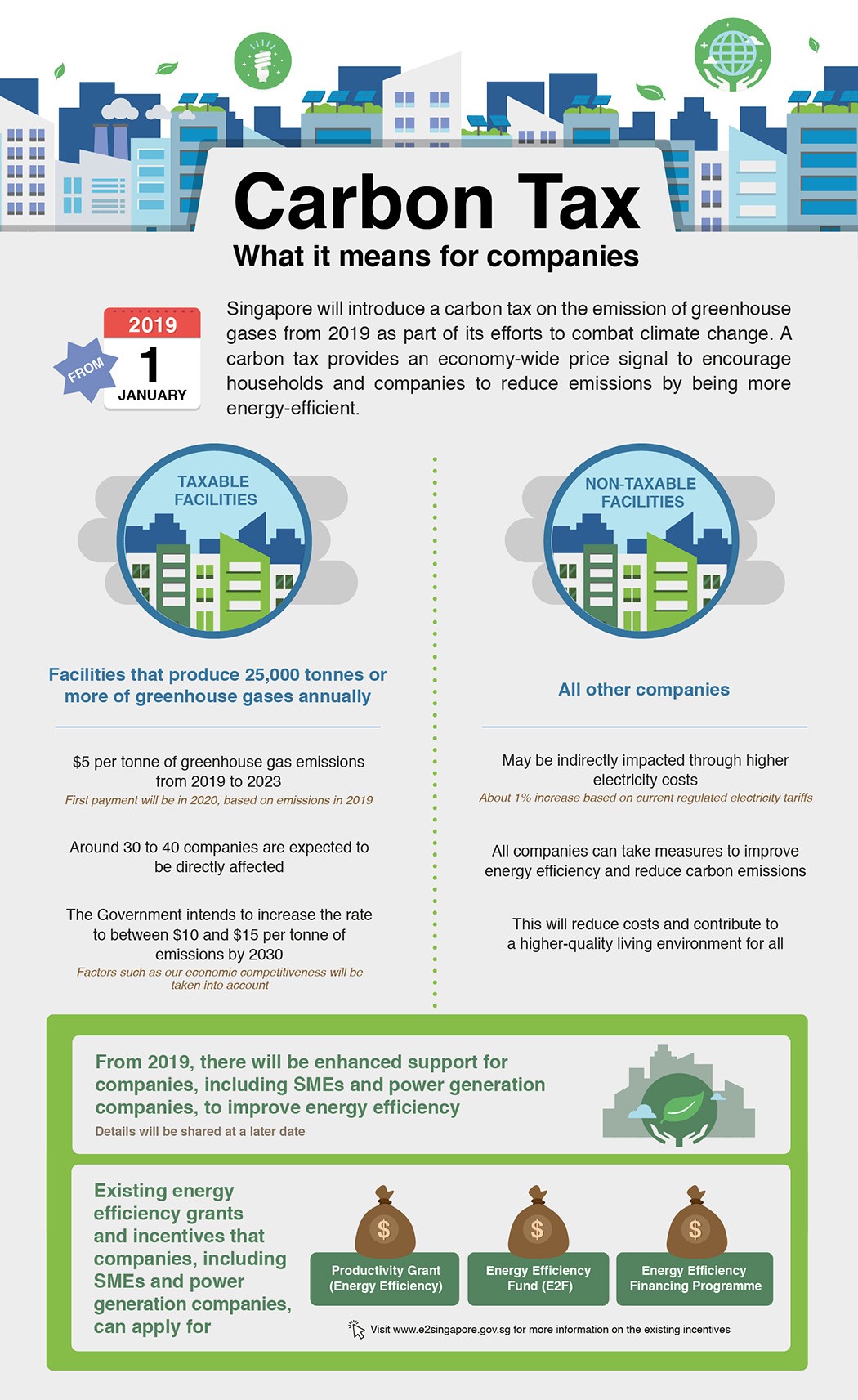

Singapore implemented a carbon tax the first carbon pricing scheme in Southeast Asia on January 1 2019. Beyond changes in the Goods and Services Tax and wealth tax Singapores revised carbon tax rate for 2024 will be unveiled. Under Prime Minister Justin Trudeau the Liberal government has enacted a nationwide tax on oil coal and gas that starts at 15 per ton of carbon dioxide this year and will rise to 38 per ton by.

Singapore Airlines has become the first airline to sign the Global Sustainable Aviation Fuel SAF Declaration. The Penang Institute in its 2019 proposal for carbon tax in Malaysia proposed an introductory rate of RM35 per tCOe before rising to RM150tCOe by end-2030. The carbon tax level is set at S5tCO 2 e in the first instance from 2019 to 2023 to provide a transitional period to give emitters time to adjust.

Despite the unique challenges and constraints faced as a dense built-up city-state with no hinterland and limited resources we are committed to doing our part in the global fight against climate change. For comparison Singapores carbon tax comes in at an introductory rate of S5 RM1538tCOe until 2023 while Japans tiered carbon tax starts at 289 RM1081tCOe. Unlike typical grouses about taxes some think the rate is far too low.

It will likely be higher than the current 2019 to 2023 rate of S5 per. The general consensus among the scientific community is that carbon prices and carbon tax rates are currently far too low. Singapore implemented a carbon tax the first carbon pricing scheme in Southeast Asia on 1 January 2019.

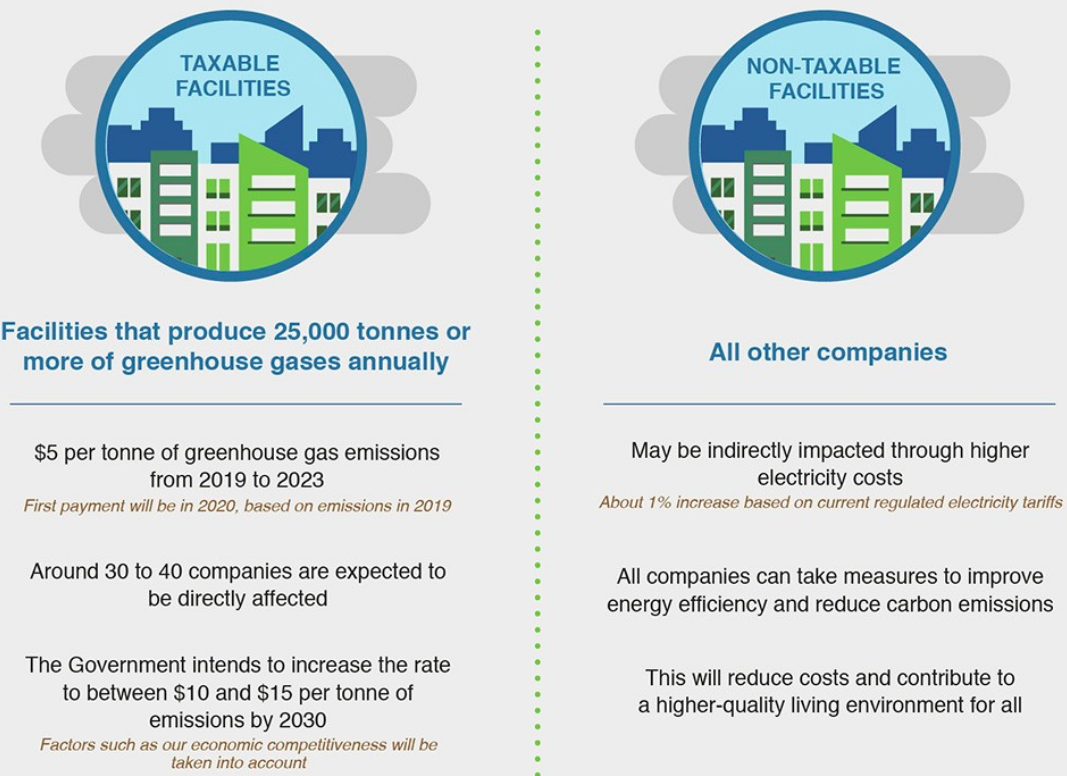

Singapore currently charges a carbon tax of S5 per tonne which several MPs said is set too low although Bukit Panjang MP Liang Eng Hwa said businesses need to be ready for the next round of carbon tax hike since every S5 per tonne could lead to a 1 per cent increase in electricity prices for households and businesses. We are customizing your profile. Given the carbon intensity of gold mining and processing we calculated that an EU carbon tax of 30 per metric ton of CO 2 would amount to about 450 million to 950 million.

The airline joined European aircraft manufacturer Airbus aircraft engine builder Rolls-Royce and aircraft equipment manufacturer Safran to sign the declaration at the Singapore Air Show this week. We are committed to be a carbon-neutral country at the earliest in 2050 This was the welcome statement by Prime Minister Datuk Seri Ismail Sabri Yaakob during the tabling of the 12th Malaysia Plan 2021-2025. Singapores current carbon tax rate which will be in place until 2023 is 5 per tonne of emissions.

We encourage businesses industries and consumers to reduce their emissions through a number of programs and initiatives. This is significantly higher than funds raised by a carbon tax proposal by the International Chamber of Shipping which represents shipowners. Singapores carbon taxes are now set at S5 per tonne of greenhouse gas emissions but will be revised in 2024.

Although the actual definitions vary between jurisdictions in general a direct tax or income tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction which is described as an indirect taxThere is a distinction between direct and indirect tax depending on whether the tax payer is the actual taxpayer or if the amount of tax is supported by a third. MPs called for the government to be transparent about the timeline of the future carbon price hike. Businesses in Singapore may face tougher competition.

As it stands Singapores low carbon price does not seem to have nudged polluters according to recent research suggesting that there have been no significant change in carbon emissions the year the carbon tax was levied. It is applied uniformly to all sectors including energy-intensive and trade-exposed sectors without exemption. The current rate of S5 per tonne on firms that emit at least 25000 tonnes of greenhouse gas was first implemented in 2019 making Singapore.

The ICS has put forward a tax proposal of 2 per tonne of bunker fuel which works out at just 07 per tonne of CO2 emitted to fund research and development projects worth 5 billion over the next decade. The carbon tax applies to direct emissions from facilities emitting at least 25 ktCO 2 e per year covering CO 2 methane. Singapore was the first South-east Asian nation to introduce a carbon tax in 2019 but its rate of 5 per tonne is considered to be on the low end of the spectrum.

Climate change is a global challenge that requires a global response. The Council is bringing a trio of experts focused on the. Dr Alan Finkel the Special Adviser to the Australian Government on Low Emissions Technology plays a key role in brokering our partnerships.

First announced at Budget 2018 Singapores carbon tax rate is fixed at 5 per tonne of carbon dioxide equivalent tCO2e until 2023. This would translate into a profit reduction of 10 on those shipments for mining companies or additional costs that would be passed on to their customers or a. The tax is normally set by the government to correct an undesirable or inefficient market outcome a market failure and does so by being set equal to the external marginal cost of the negative.

CBAM centre The Climate Leadership Council a GOP-backed group supporting a carbon tax on Tuesday announced it is launching a new research centre to explore how the US could impose a carbon border adjustment mechanism CBAM or other policy to punish imports of high-polluting goods.

Sembcorp Features

Government Climate Change In Singapore

Opinion Why Carbon Tax Is Needed And What It Means For Singapore Climate Change

The Goldilocks Dilemma Of Singapore S Carbon Tax Opinion Eco Business Asia Pacific

Role Of Carbon Tax In Singapore S Mitigation Strategy 12 Download Scientific Diagram

2

Commentary Why It Pays For Singapore To Be Much More Ambitious In Raising Carbon Tax Cna

Understanding Carbon Tax In Singapore Its Impact On Electricity Iswitch

Big Emitters Face Carbon Tax From 2019 Business News Asiaone

Rs0h9eeia4vqhm

Singapore Launches South Asia S First Carbon Tax Access Cities

Carbon Tax Impact On Electricity Customers Geneco

Singapore Carbon Tax Set To Squeeze Oil Groups Financial Times

Singapore Budget 2018 Carbon Tax What Does It Mean To Your Company The Logistics Academy Singapore Budget 2018 Carbon Tax What Does It Mean To Your Company

Government Climate Change In Singapore